Pasar saham Asia sebagian besar libur untuk Jumat Agung pada perdagangan Jumat (29/03/2024). Dolar AS juga menguat terhadap euro sebelum data inflasi utama AS

Diperbarui • 2023-02-20

There are rumors from influential sources pointing at Kazuo Ueda as the next governor of the Bank of Japan (BOJ). This decision could lead to the commencement of policies in favor of raising interest rates and monetary policy tightening. Seeing how his appointment is coming after the Yen has lost ground against the Dollar and other top economies, it is only natural to expect a yen recovery. However, let's check the technical factors for confirmation of this prediction to see if the stars align.

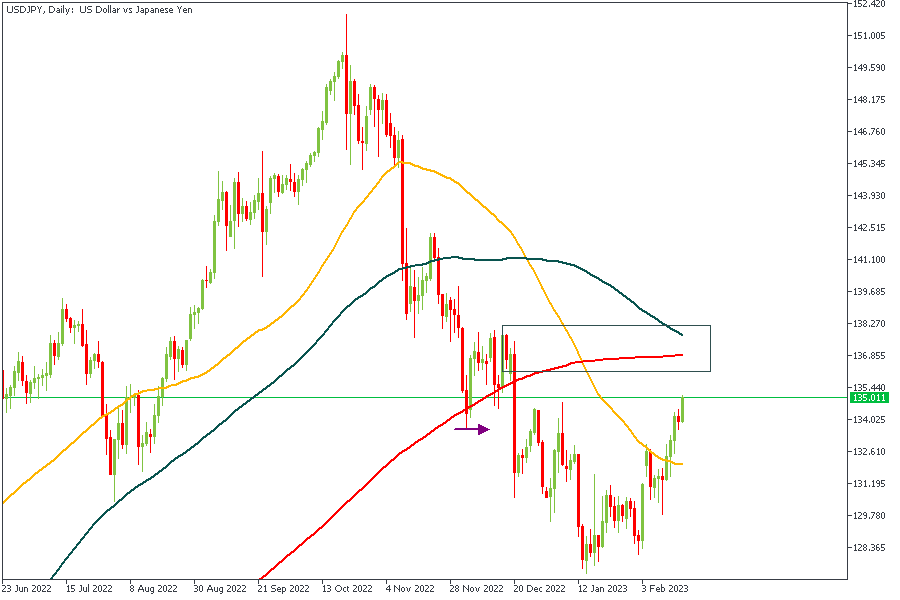

The horizontal arrow marks the previous low that was recently broken. At the same time, the rectangle highlights the order block (supply zone) responsible for the breakout. The 100 and 200-day moving averages align with the supply zone, increasing the chance for a bearish reaction from that area. The 88% of the Fibonacci retracement tool can be considered an added confluence in favor of the bearish move.

Analysts’ Expectations:

Direction: Bearish

Target: 131.5

Invalidation: 138.2

The two trendlines slightly inching towards each other have formed a wedge pattern on the daily timeframe of the EURJPY chart. Based on the fact that the most recent break of the structure was bearish, the supply zone responsible has been highlighted. It is also worthy of note that the supply zone falls within 76% of the Fibonacci retracement zone and aligns with a trendline resistance. These factors lead to a convincing bearish sentiment.

Analysts’ Expectations:

Direction: Bearish

Target: 141.5

Invalidation: 146.5

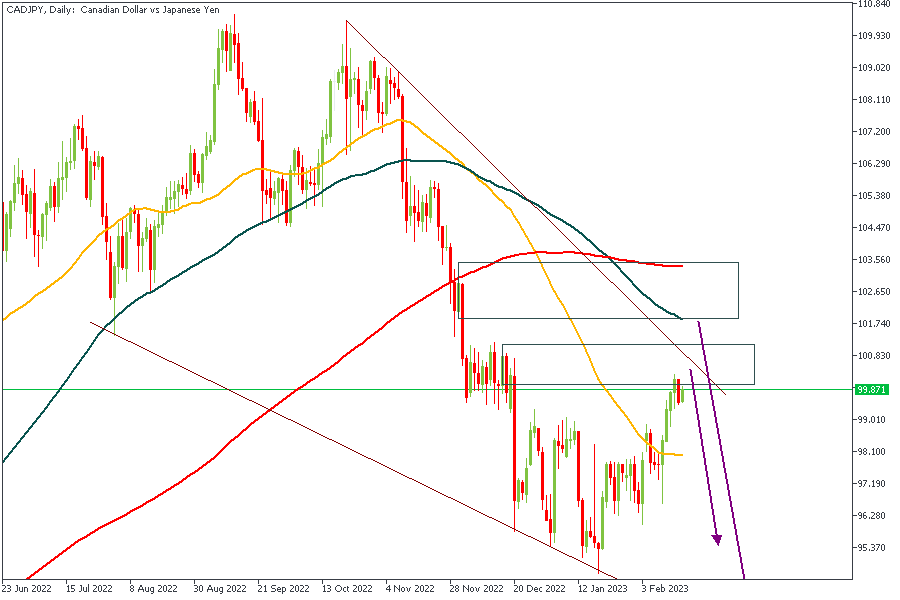

CADJPY is poised for a bearish rejection a short while from now. The clause here is that price has presented us with two possible supply areas. The first supply zone aligns with the trendline resistance, while the other has the 100 and 200-day moving averages as confluences for the supply zone. While either scenario can play out, I'd rather err on the side of caution by choosing the second supply zone since it has a slightly better chance.

Analysts’ Expectations:

Direction: Bearish

Target: 103.56

Invalidation: 97

CHFJPY has the cleanest setup in this article. Here we see the descending channel with confluences from the 100-day moving average, trendline resistance, supply zone, and the 76% Fibonacci retracement level. The sentiment here is bearish.

Analysts’ Expectations:

Direction: Bearish

Target: 139.5

Invalidation: 148

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.

Pasar saham Asia sebagian besar libur untuk Jumat Agung pada perdagangan Jumat (29/03/2024). Dolar AS juga menguat terhadap euro sebelum data inflasi utama AS

Dolar Australia menguat tipis di awal perdagangan akhir pekan ini, namun masih dalam tren penurunan. Pasar diperkirakan sepi karena memperingati Jumat Agung. Dolar AS menguat karena data ekonomi AS menunjukkan ekspansi,

Pasar saham Asia memiliki sentimen sideways dengan bias bearish pada perdagangan Kamis (28/03/2024), karena adanya sentimen ketidakpastian menjelang data indeks harga PCE AS..penjualan ritel Australia dirilis lebih kecil dari perkiraannya.

Yen Jepang gagal memikat para investor pada perdagangan Selasa (02/04/2024) meski ada peluang atas kemungkinan intervensi dan..Sentimen penghindaran risiko masih berpotensi memberikan kekuatan pada safe-haven

XAUUSD naik ke rekor tertinggi baru pada perdagangan Senin (01/04/2024), di tengah meningkatnya spekulasi penurunan suku bunga..melanjutkan kenaikan kuat minggu lalu hingga membentuk level puncak baru sepanjang masa

Pasar saham Asia sebagian masih libur dan sebagian lagi menguat pada perdagangan Senin (01/04/2024), karena optimisme data pabrikan Tiongkok mendukung..potensi intervensi otoritas Jepang terhadap yen Jepang diperkirakan berada di zona 152 – 155 yen.

FBS menyimpan catatan data Anda untuk menjalankan website ini. Dengan menekan tombol "Setuju", Anda menyetujui kebijakan Privasi kami.

Permintaan Anda diterima.

Manajer kami akan menghubungi Anda

Permintaan panggilan balik berikutnya untuk nomor telepon ini

akan tersedia setelah

Jika Anda memiliki masalah mendesak, silakan hubungi kami melalui

Live chat

Internal error. Silahkan coba lagi

Jangan buang waktu Anda – tetap awasi dampak NFP terhadap dolar dan raup profitnya!