How do swaps work?

Swaps can either be positive or negative, depending on the interest rate differential and the direction of your trade.

Example:

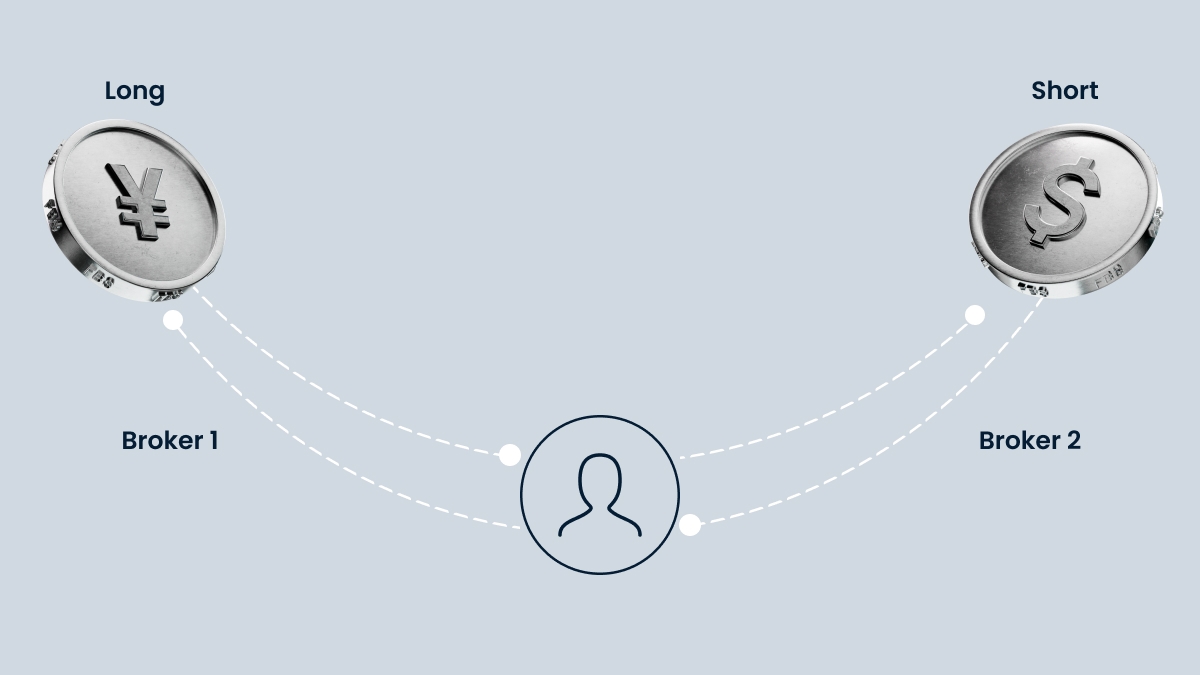

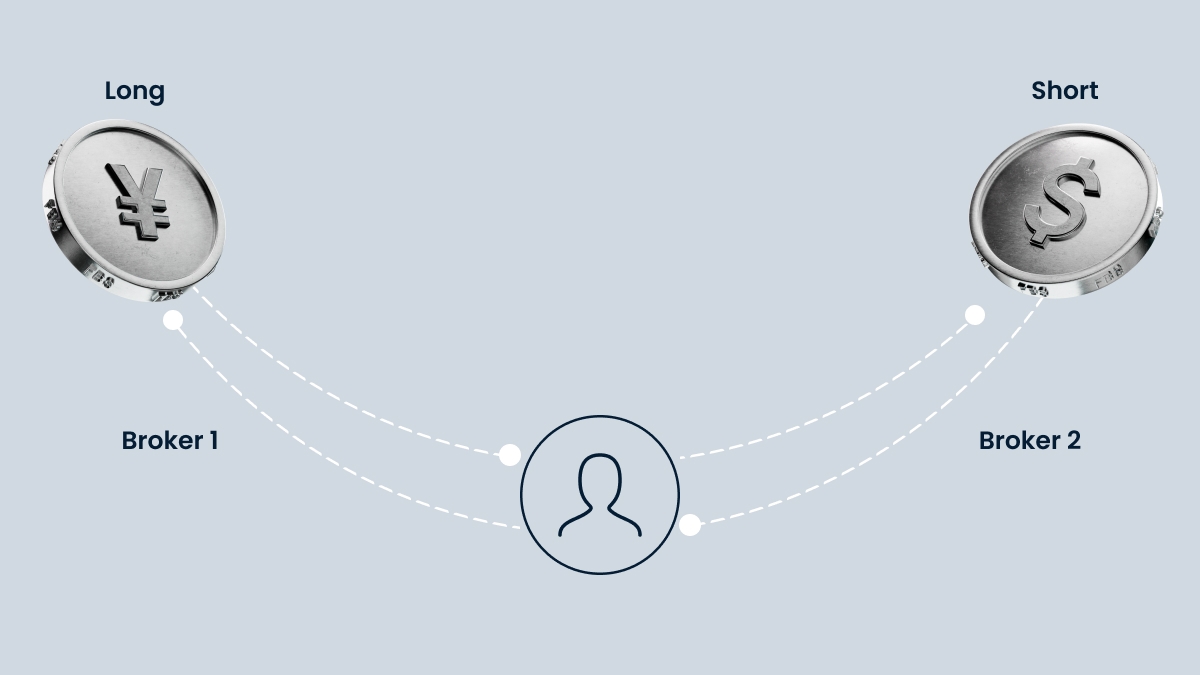

Hedging strategy for swap income

One of the most effective ways to capitalize on swaps is through a hedging strategy. This approach minimizes market risk while allowing you to earn from positive swaps.

How it works:

Open a long position. Choose a broker that offers high positive swaps.

Open a short position. Use another broker that offers zero (or small negative) swaps.

Neutralize market risks. By holding both positions, you can focus solely on earning from swaps.

Calculation example (XAUUSD):

1 Lot short now:

1 Lot short after update (5x Swap):

Instruments with increased swaps

The upcoming update will significantly increase positive swaps on several key instruments. Here’s a breakdown:

Positive swap (long):

USDJPY: 2.5x increase

GBPJPY: 2.5x increase

EURJPY: 2x increase

AUDJPY: 4x increase

USDCHF: 3x increase

Positive swap (short):

XAUUSD: 4x+ increase

EURUSD: 5x increase

USDZAR: 6x increase

USDBRL: 12x increase

Why this update matters

This update transforms swaps from a minor trading feature into a substantial income source. By integrating swaps into your trading plan and employing strategies like hedging, you can maximize profitability and stay ahead in the market.

Detailed analysis of key instruments

Let’s take a closer look at some of the key instruments that will benefit from this update:

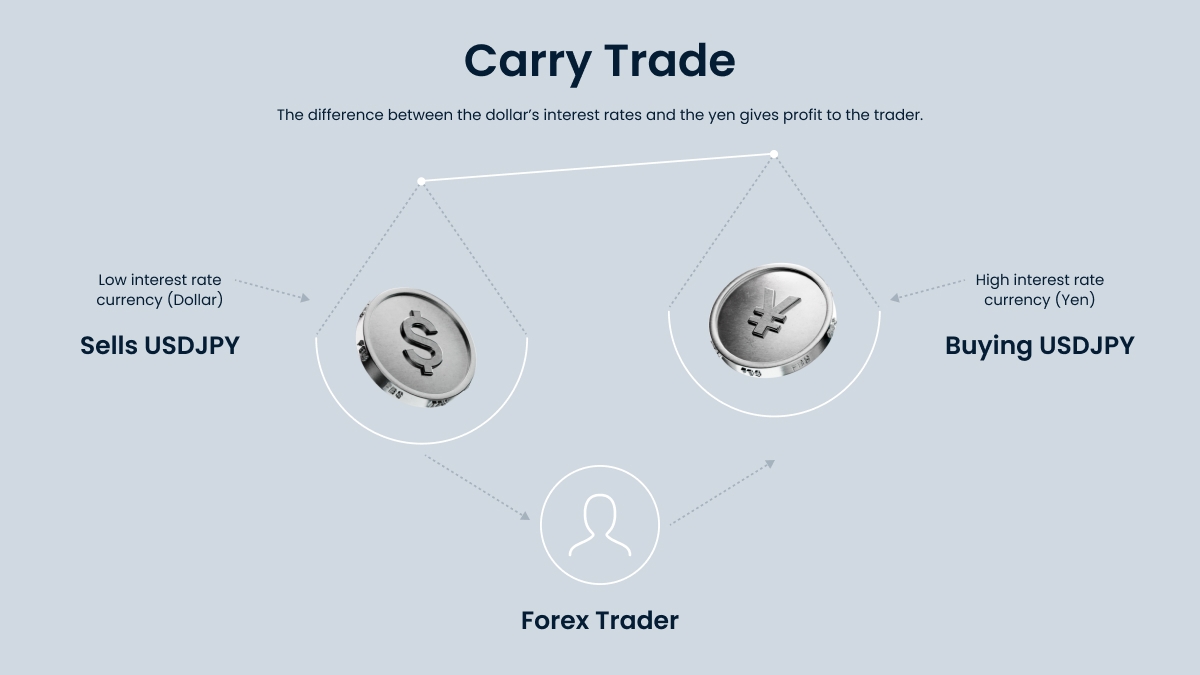

USDJPY

The USDJPY pair is one of the most traded currency pairs in the world. With a 2.5x increase in positive swaps for long positions, traders can now earn significantly more by holding long positions on this pair. The interest rate differential between the US and Japan makes this pair particularly attractive for swap income.

GBPJPY

Similar to USDJPY, the GBPJPY pair will also see a 2.5x increase in positive swaps for long positions. The British pound and Japanese yen have a substantial interest rate differential, making this pair another excellent choice for traders looking to capitalize on swaps.

EURJPY

The EURJPY pair will benefit from a 2x increase in positive swaps for long positions. The euro and Japanese yen have a notable interest rate differential, and this increase makes the pair more appealing for traders focusing on swap income.

AUDJPY

With a 4x increase in positive swaps for long positions, the AUDJPY pair stands out as one of the most lucrative options. The Australian dollar and Japanese yen have a significant interest rate differential, and this substantial increase in swaps makes it a top choice for traders.

USDCHF

The USDCHF pair will see a 3x increase in positive swaps for long positions. The US dollar and Swiss franc also have a notable interest rate differential.

XAUUSD

Gold, traded as XAUUSD, will benefit from a 4x+ increase in positive swaps for short positions. Gold’s high borrowing costs make it an excellent instrument for earning swap income, especially with this significant increase.

EURUSD

The EURUSD pair will see a 5x increase in positive swaps for short positions. The most popular forex pair will provide excellent carry trading opportunities

USDZAR

With a 6x increase in positive swaps for short positions. This substantial increase in swaps can help traders achieve high performance on the swaps.

USDBRL

The USDBRL pair will benefit from a 12x increase in positive swaps for short positions. One of Latin America’s most liquid pairs will open up an opportunity to play on the difference in interest rates.

Strategies to maximize swap income

To fully capitalize on this update, consider the following strategies:

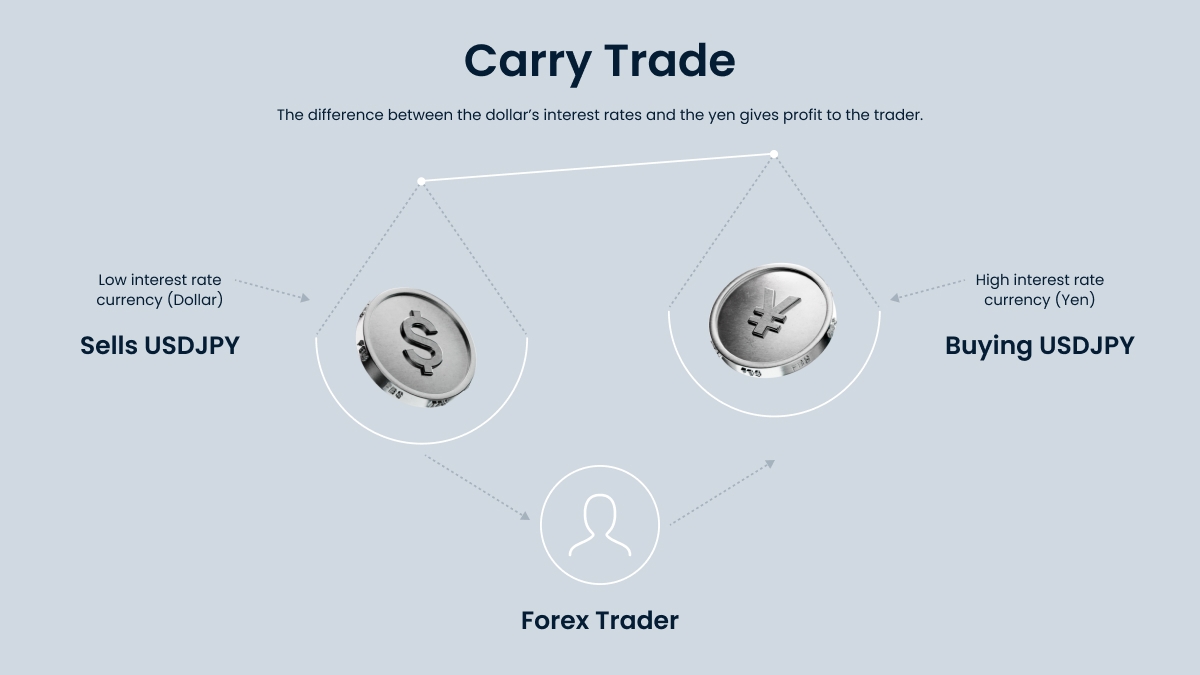

Carry trade strategy

A carry trade aims to profit from the interest rate differential between two currencies, which is paid out daily in the form of a positive swap.