- Main Scenario: Buys above 2030 with targets at 2035, 2039, and 2042 as extensions. It is recommended to set a stop loss (S.L.) below 2024 or at least 1% of the account capital**.

- Alternative Scenario: Sells below 2024 with targets at 2017, 2013, and 2008 as extensions. It is advised to place a stop loss above 2030 or at least 1% of the account capital**. A trailing stop can be used.

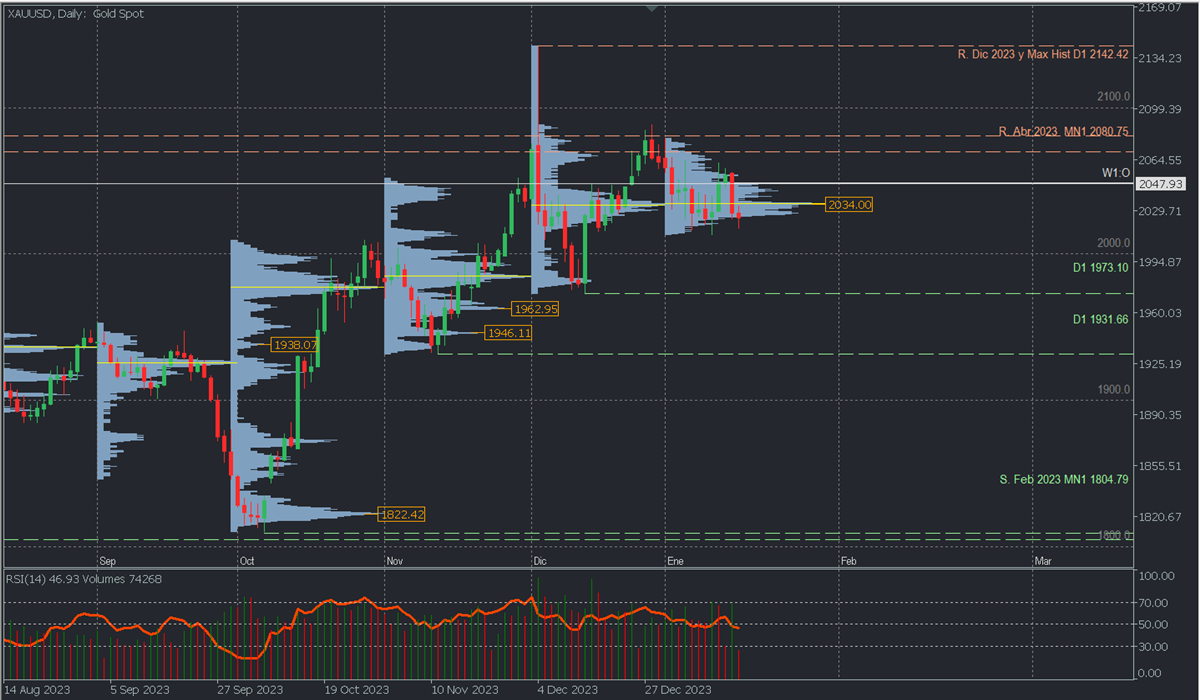

Analysis from the Daily Chart

The technical structure of the pair reflects the weakening of the bulls, staying below historical highs and now below the POC* of December and the first weeks of January, suggesting an accumulation of sales. This structure allows for a downward movement as long as it stays below 2048, with selling targets towards 2000 and support at 1973.10, representing a correction, as the last relevant support of the uptrend is at 1931.66.

Scenario from the H1 Chart

The pair consolidates around last week's buying zone, so a more extended upward movement can be expected with quotes above the Asian/European POC* 2024.18, aiming to break above 2030/2032. This momentum will pave the way for a pullback towards yesterday's POC* at 2039.49, which, along with the intraday high average range of 2042.34, forms the most recent intraday selling zone.

The RSI shows a bullish divergence, possibly supporting a brief intraday push. Subsequently, we will be considering a renewed downward movement from these levels with selling targets at 2013.15 and the intraday low average range of 2008.25.

An early bearish scenario will be observed with a failure to break above the day's opening and a drop below the Asian/European POC* 2024.18C, decisively breaking the buying zone towards the intraday low average range of the day.

*Uncovered POC: POC = Point of Control: It is the level or zone where the highest volume concentration occurred. If previously there was a bearish movement from it, it is considered a selling zone. If previously there was a bullish impulse, it is considered a buying zone.

**Consider this risk management suggestion**It is crucial to base risk management on capital and traded volume. Therefore, a maximum risk of 1% of the capital is recommended. Using risk management indicators such as Easy Order is suggested.

—-----------------------------------------------------

Disclaimer:

This document does not constitute a recommendation to buy or sell financial products and should not be considered as a solicitation or offer to engage in transactions. This document is an economic research by the author and does not intend to provide investment advice or solicit securities or other types of investment transactions at FBS. Although every investment involves a certain degree of risk, the risk of loss in forex trading and other leveraged assets can be substantial. Therefore, if you are considering trading in this market, you must be aware of the risks associated with this product to make informed decisions before investing. The material presented here should not be interpreted as advice or trading strategy. All prices mentioned in this report are for informational purposes only.