Summary

- Current Price Zone: USDJPY trading above 153.50

- Resistance Levels:

- 154.00–154.20: Key ceiling from recent highs

- 155.00: Psychological resistance

- Support Levels:

- 152.50: Short-term support

- 151.80: Former breakout zone, now acting as demand

- 150.90: Major support tied to BoJ intervention zone

Despite Tokyo's inflation surprise, the yen is weakening as USDJPY decouples from rate expectations and instead follows broader risk sentiment and U.S. dollar strength.

Fundamental Factors Affecting the Yen

- Tokyo CPI Surges to 3.4%

- Highest core CPI in two years, primarily driven by:

- End of energy subsidies

- Food price hikes

- Sticky services inflation

- Core-core inflation (ex-food & energy): 3.1% → closely watched by the BoJ

- Highest core CPI in two years, primarily driven by:

- BoJ Likely to Stay on Hold

- Despite inflation running hot, the BoJ is expected to pause at next week's meeting, keeping rates at 0.5%

- Why? External risks—especially U.S. tariffs and global growth uncertainty—are trumping strong domestic data

- The door remains open for a hike later this year, should inflation persist and external shocks subside

- Yen Behavior Shifting to Risk Proxy

- Over the past two weeks, USDJPY has de-linked from rate differentials and safe-haven flows

- The pair is now tracking:

- Risk appetite indicators like VIX and Nasdaq futures

- Fed rate cut expectations and broader USD sentiment

- Weakening correlation with traditional safe havens (gold, CHF)

Key Takeaway for Traders

- USDJPY is a "risk sentiment" trade, not a "BoJ vs Fed" rate play.

- Strong inflation in Japan cannot lift the yen while global risks (esp. U.S. tariffs) dominate.

- For Forex traders:

- Look for Fed rate cut pricing and Nasdaq/VIX direction to guide USDJPY in the near term.

- BoJ's next move is likely delayed unless global risks are eased.

- Watch BoJ commentary next week for signals of a potential summer or autumn hike if inflation stays sticky.

EURJPY – H4 Timeframe

.png)

The price action on the 4-hour timeframe chart of EURJPY shows an initial rejection from the daily pivot zone, which led to a bearish break of structure. The subsequent bullish move can be regarded as a retracement intended to retest the pivot. Considering the trendline resistance overlapping the pivot zone, we expect to see a continuation of the bearish impulse shortly after the retest.

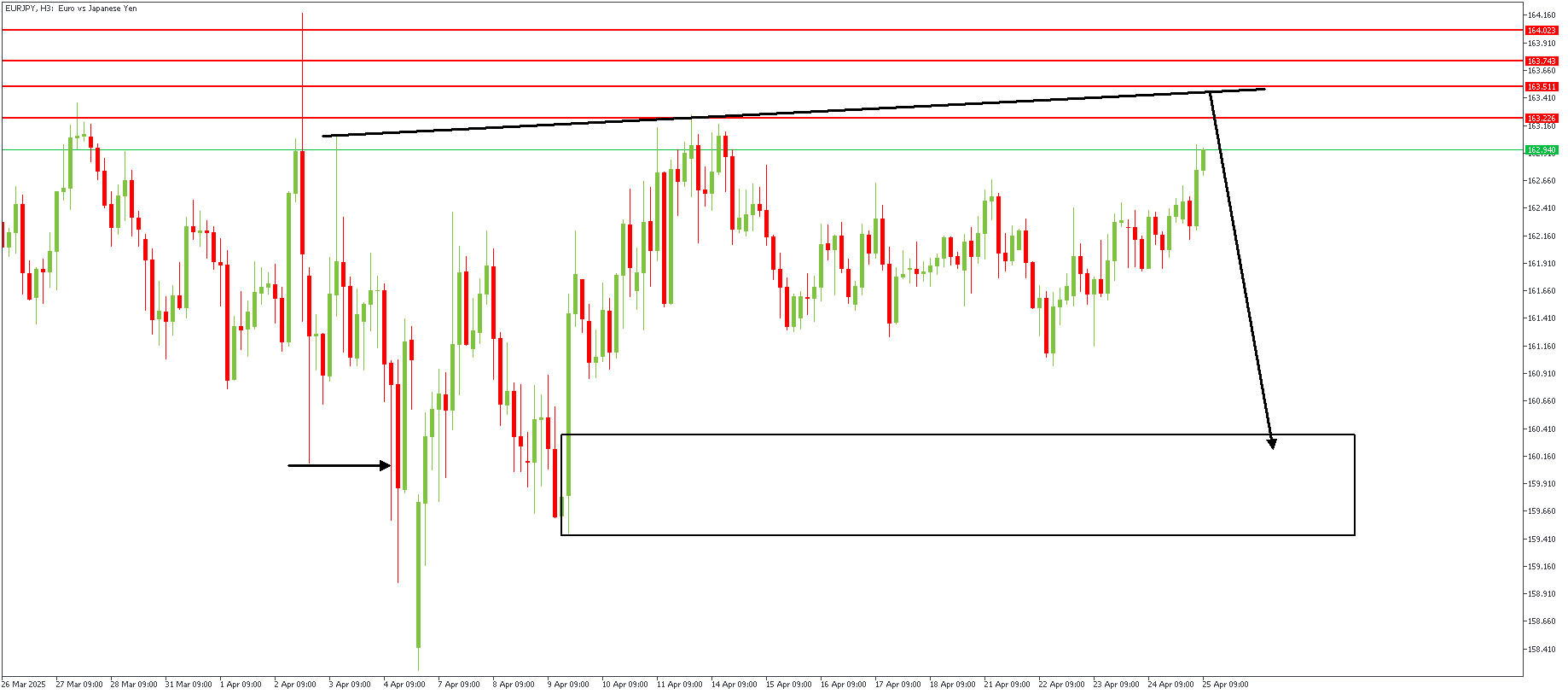

EURJPY – H3 Timeframe

The 3-hour timeframe chart of EURJPY shows the sweep above the previous high, the adjoining break of structure, and the ongoing retest that describes an SBR pattern. The highlighted demand zone is the primary target for the bearish sentiment.

Analyst's Expectations:

Direction: Bearish

Target- 160.337

Invalidation- 164.023

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.